|

In 1991, Knollcrest became a Tax District, which is managed by an annually elected, resident-volunteer Board of Directors and Officers. A Tax

District can be described as a "town within a town" because it has state-created autonomy over many activities occurring within its boundaries, including the power to levy and collect

taxes.

Concurrent with the District’s creation was the execution of a 99-year lease from Knollcrest Real Estate Corporation to the District for all its

property.

The reason was simple. Unlike maintenance fees paid to a real estate corporation, taxes paid to a Tax District are deductible from Federal Income

taxes, just like property taxes paid to the Town of New Fairfield. Also, the Tax District doesn’t own, but leases property; therefore, in the extremely unlikely event of a Tax District bankruptcy

proceeding, community property would revert back to the corporation -- state mandate requires full liquidation of Tax District assets in the event of bankruptcy. As mentioned, too, a Tax District has

the same taxing authority as that of any other state political sub-division. This ensures a sustained revenue stream to meet the community’s financial obligations for road maintenance, beach

maintenance, snow plowing costs and the like.

The Tax District is governed under laws contained in Title 7 of the Connecticut General Statutes. The law specifically prescribes a district’s rights, duties and obligations for such things as voter

eligibility. See Section 2, Article II for voter eligibility for elections of officers and directors, Bylaw changes and, perhaps most important, expenditures for the community. Two scheduled

community meetings are held in Knollcrest each year for these purposes.

The first comes in May when the budget is presented/voted on for the coming fiscal year, which begins on July 1. The second comes in August when Officers and Directors are elected for the coming

annual term. All Officers and Directors are members of the community and volunteer their time and expertise without compensation. Officer and Director selection is conducted through a nomination

committee that annually solicits candidates in July for the coming year. Tax District Board meetings are held monthly and are open to residents. They usually take place on the first Thursday evening

of each month, with the exception of January.

State law prescribes that community meeting notices must be placed in the Legal Notice section of a local newspapers at least five days prior to a meeting date. Normally, the "Citizen News" is used

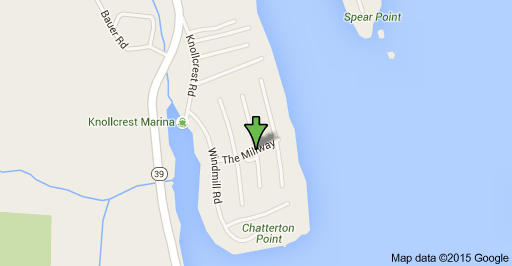

for that purpose. In addition, meeting notices are posted on the community bulletin board located next to the Windmill and also sent by mail to each homeowner. A minimum of fifteen eligible voters is

required for a community meeting quorum.

Operations & Taxing Procedures:

Once the budget is established and approved by a majority of voters present at the May meeting, the annual tax per property, or mil rate, is established. A mil rate is simply the fractional result of

the approved budget divided into the Town of New Fairfield-assessed property values of all real property located in the community. Next, the number (mil rate) is multiplied against the assessed value

of an individual property and its tax is levied.

Property taxes are billed and payable on the same schedule as New Fairfield town taxes, i.e., July 1 and January 1. These tax payments are used to cover community costs such as property maintenance,

road work, snow removal, equipment replacement, etc. A copy of the current year's budget is available by contacting the Treasurer.

Community Property Description:

A) Marina

The marina consists of the area immediately right of the STOP sign as you enter the community and adjacent to 31 boat slips located at the end of the lake cove. Twenty-three slips are individually

owned by Knollcrest property owners. The remaining eight are owned by the community. The lake area upon which the docks float is leased to the community by the lake’s owner, FirstLight Power

Resources. Dock ownership is typically specified in property deeds. Dock owners and renters of community slips pay annual assessments to the Tax District to cover costs for such things as road/sea

wall maintenance, repair/replacement of the center floats used to anchor individual slips, insurance, lights, power and the like. Maintenance of individual docks is the owners' responsibility, but

the Tax District maintains overall appearances. There also is a boat ramp available for use at the marina by all Knollcrest residents. These amenities are only available to residents that are

current with all community taxes.

The eight community-owned docks are available for rent to Knollcrest residents on an annual basis. Selection is generally based on residency seniority and resident must be up to date on all community

taxes. For additional details about the marina, please contact the director in charge of the marina at marina@knollcrestboard.org.

B) Beach:

The community beach, located at the east end of Millway, is the most popular spot in Knollcrest during the summer months. The beach is open daily for all Knollcrest residents and their guests from

7:00 A.M. to 9:00 P.M. The beach is cleaned and raked daily and a portable toilet is provided during the summer months. From May to October, water quality is tested at least monthly by the Candlewood

Lake Authority to ensure your safety. However, use of the beach is strictly at your own risk; there is no lifeguard. Children under twelve must be supervised by an adult. In addition, common-sense

rules have been established for your safety, and are prominently displayed at the beach.

Limited parking is available on the upper beach area. The middle area contains a paved area with a basketball hoop.

C) Roads:

Community roads are maintained by the Tax District. This includes paving, repair, snow plowing, sanding and spring cleaning. Roads are usually resurfaced on a continuing seven year cycle.

Year round, residents are asked to use common sense when parking their cars on the streets, especially for emergency vehicle access and when inclement weather is forecast. Our snow plow service

prides itself on keeping the roads clear and the hills well-sanded, but if cars block their ability to perform then everyone suffers.

D) Water System:

The community water system consists of an electric pump-powered well system, capable of supplying residents with all of their water requirements. Water is tested monthly, and we are happy to report

that its purity rates among the best in Connecticut.

E) Windmill:

The Windmill, which is non-functional, is used by the community to store equipment and records. It also serves as the place for monthly Board meetings. Immediately adjacent to it is the community

bulletin board. The Windmill is the only one of its kind in western Connecticut and serves as the community’s logo and focal point.

|

|